Intelligent credit decisions

Boost loan approval efficiency.

Tackle all the challenges with Finuit’s solution

Layout Variations

Identify the size and orientation of passbooks, which differ from bank to bank.

Multiline text

Recognize transaction data from multiline descriptions, uneven spacing, and misaligned columns.

Format differences

Categorize bank-specific terminology and codes used to denote transactions.

Print quality issues

Extract data from low-quality images, varying printing ink densities, mirrored imprints from the other side of the page, and slanted or overlapping lines.

Fortify your credit approval processes.

Switch to Finuit’s passbook data extraction solution today.

%

X

processes

Handle barely intelligible images

Acquire data with precision

WHY FINUIT

Upgrade your capabilities with the revolutionary data extraction tool, tailored for your business.

The solution that enables you to fulfill all your data extraction and

analysis requirements

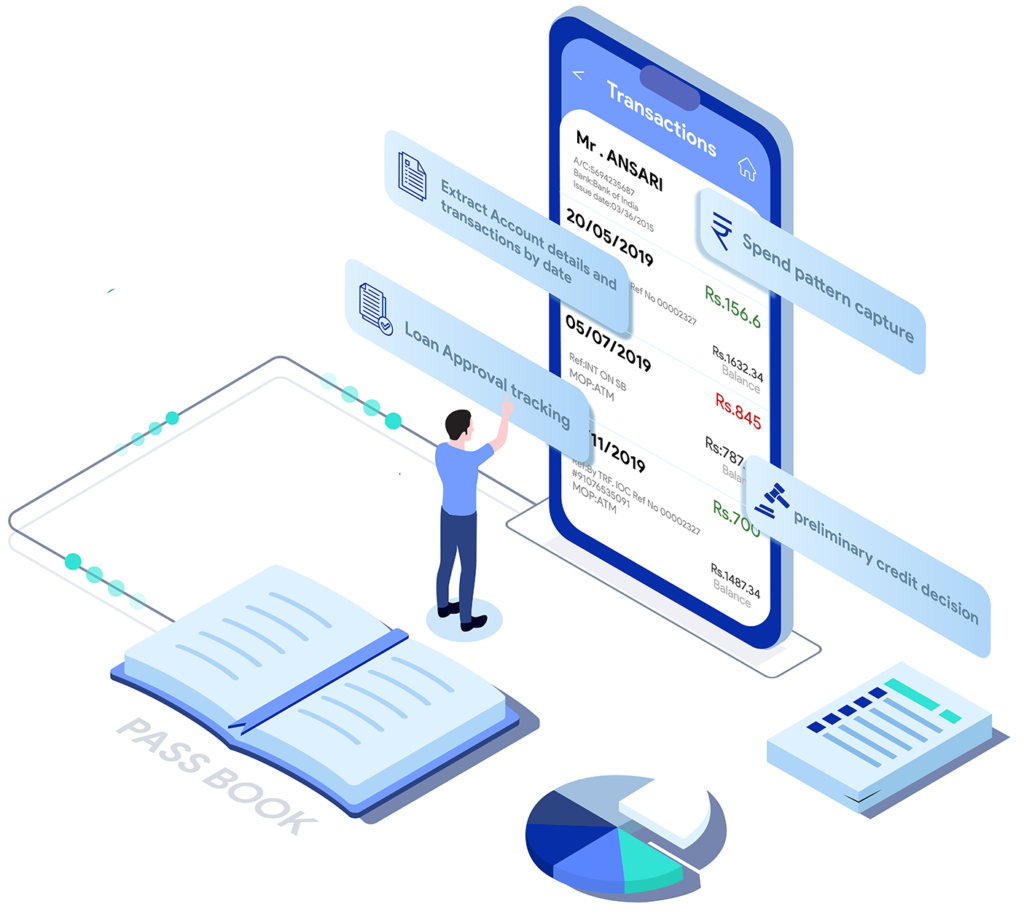

Automated Data Extraction

Identify the account holder, the type and number of the account, and bank details. Recognize the transaction categories and values.

Extensive

Analysis

Automatically categorize transactions, compute income and expense metrics, and evaluate the customer’s creditworthiness. Detect discrepancies and suspicious entries.

Superior

Accuracy

Leverage custom-developed algorithms to eliminate errors. Gain from unparalleled data extraction accuracy and make lending decisions foolproof.

Flexible deployment

Capture passbook images with a smartphone app and accord instant approvals. Or seamlessly integrate existing workflows over API or JSON data exchange.

Energizing rural economies:

Finuit helps microfinance

companies leverage newer

opportunities

Frequently Asked Questions

Ut enim ad minima veniam, quis nostrum exercitationem ullam corporis suscipit laboriosam, nisi ut aliquid ex ea commodi consequatur? Velit esse quam nihil molestiae consequatur.

Neque porro quisquam est, qui dolorem ipsum quia dolor sit amet, consectetur, adipisci velit, sed quia non numquam eius modi tempora incidunt ut labore et dolore magnam aliquam quaerat voluptatem.