Transform MSME lending with AI-powered insights

Our solutions understand the unique financial landscape of MSMEs, providing insights specifically tailored to your lending decisions.

The range of Finuit’s data intelligence automation solutions are optimized to boost lending to small businesses

Don’t let manual document processing limit your MSME lending business.

Assess creditworthiness and make data-driven decisions within minutes. Approve loans faster.

Expand your MSME loan portfolio with confidence.

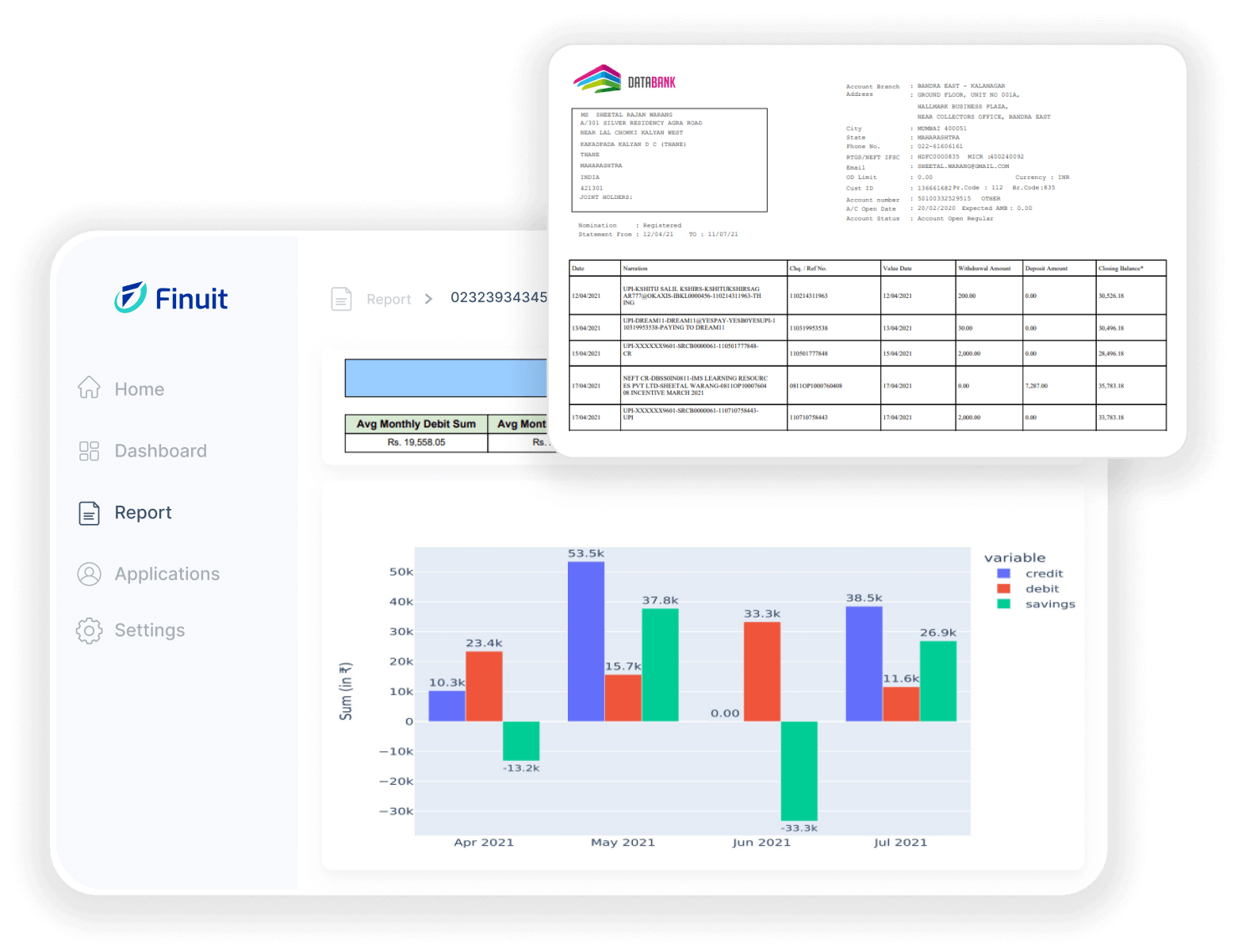

Bank Statement Analyzer

Analyze cash flow stories from

bank statements across multiple

accounts.

Financial Statement Analyzer

Derive critical financial indicators from Balance sheet, Profit and loss and Cash flow statements.

KYC Validation

Authenticate ID and address proof documents against government

records.

GSTR analyzer

Assess creditworthiness and financial discipline of your applicant from GSTR filing data analysis

Company Deep Forensics

Reinforce due diligence processes with exhaustive forensic analysis of relevant web content.

Payslip Data Digitization

Extract and verify

data from payslips of

diverse layouts.

Get The Finuit Advantage

for Smarter Lending

- Frictionless Workflows

- Advanced Risk Assessment

- Streamlined Onboarding

- API for Seamless Integration

- Skilled Team for Continuous Enhancement

WHY FINUIT

Solutions built to address the unique needs of financial businesses

Banking

Enhance loan processing capabilities, delight customers, eliminate credit risks, and modernize KYC workflows.

Microfinance

Expand market reach, optimize credit approval tasks, and serve more customers with fewer resources.

Insurance and Mortgage

Automate claim approvals, detect erroneous or fraudulent records, and verify customer credentials.

Corporate Investments

Infuse rigor in company background checks and conduct deep forensic analysis with intelligent web scraping.